Single Family

Six key types of single family investments

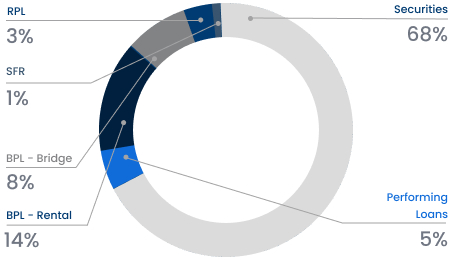

RPL

$322 MM

Seasoned re-performing mortgage loans, non-performing mortgage loans

BPL - Bridge

$808 MM

Bridge loans, Bridge with Rehab loans

BPL - Rental

$1,444 MM

DSCR

PERFORMING LOANS

$485 MM

S&D, Other

SECURITIES

$6,810 MM

Non-Agency, Agency

SFR

$129 MM

Single Family Rental

Acquisitions

Whether it is a single loan or a bulk package of thousands of loans, Adamas is ready to competitively bid, complete due diligence and fund loans with a quick turnaround.

Single Family Portfolio Composition

Our single family portfolio consists of a diverse mix of targeted assets covering multiple sectors, including:

- Agency kick

- Bridge

- Fix-n-flip

- Investor

- Non-agency

- Non-QM

- Portfolio loans

- Re-performing

- Seconds

- Sub-performing

Property Types

- Single family

- Duplexes, triplexes and quads

- Condominiums

- Factory-built

Occupancy Types

- Owner-occupied

- Second homes

- Investment

Advantages to working with Adamas

As a public company, Adamas can engage in most any size loan trade while being small enough to care about each seller and the loans we purchase. The permanent capital of a public REIT enables Adamas to make credit and investment decisions and hold assets to maturity without relying on the execution of the securitization market, resulting in our ability to invest in a broader types of loans, deliver consistent pricing to our selling partners, and make sensible diligence exceptions others can’t.

Acquisitions Team

Adamas’s experienced single family investment team is dedicated to providing an excellent experience. Our advanced technology resources and open lines of communication ensure seamless transaction management, from pricing and clearing collateral exceptions in diligence, to meeting your expected funding timelines.

Securitizations

NYMT 2020-RR1

$110,360,990

RMBS Securities

June 2020

NYMT 2020-SP1

$299,603,000

Reperforming Loans

July 2020

NYMT 2020-SP2

$316,640,000

Reperforming Loans

October 2020

NYMT 2021-BPL1

$180,000,000

BPL-Bridge Loans

May 2021

NYMT 2021-SP1

$256,221,000

Reperforming Loans

August 2021

NYMT 2022-CP1

$287,728,000

Reperforming Loans

January 2022

NYMT 2022-BPL1

$225,000,000

BPL-Bridge Loans

February 2022

NYMT 2022-SP1

$257,636,000

Reperforming Loans

August 2022

NYMT 2022-INV1

$324,702,000

BPL- Rental Loans

November 2022

NYMT 2024-BPL1

$225,000,000

BPL-Bridge Loans

January 2024

NYMT 2024-CP1

$305,299,000

Reperforming Loans

March 2024

NYMT 2024-BPL2

$243,649,000

BPL-Bridge Loans

May 2024

NYMT 2024-BPL3

$237,500,000

BPL-Bridge Loans

September 2024

NYMT 2024-RR1

$74,000,000

SLST Bonds

September 2024

NYMT 2024-INV1

$294,865,000

BPL-Rental Loans

October 2024

NYMT 2025-R1

$74,810,000

BPL-Bridge Loans

February 2025

NYMT 2025-INV1

$253,973,000

BPL-Rental Loans

March 2025

NYMT 2025-CP1

$369,737,000

Reperforming Loans

July 2025

NYMT 2025-INV2

$275,253,000

BPL-Rental

September 2025

NYMT 2026-INV1

$310,405,000

BPL-Rental

January 2026