Careers

Join a talented group of people who are passionate about what they do and how they do it.

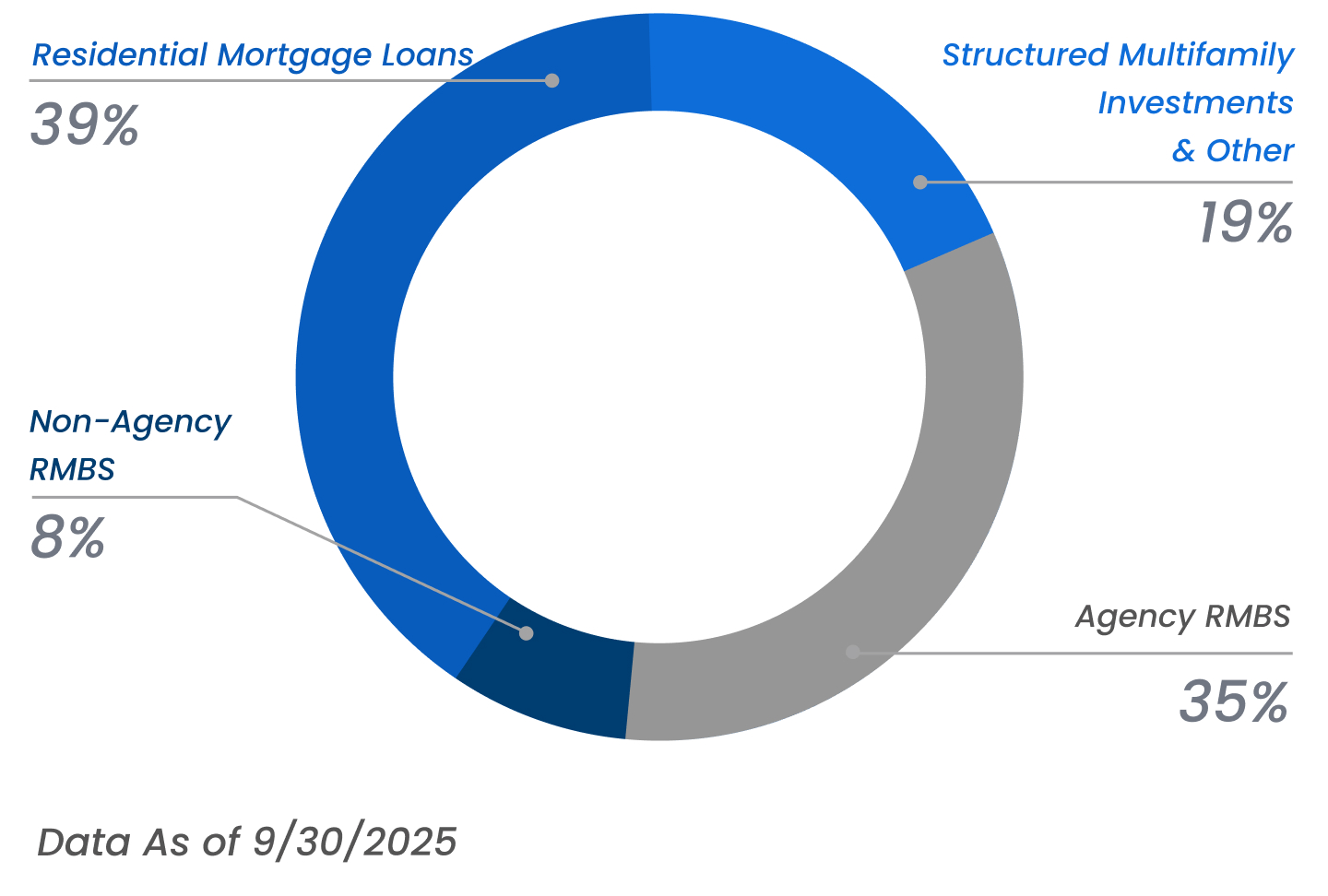

Our objective is to deliver long-term, stable distributions to our stockholders over changing economic conditions through a combination of net interest spread and capital gains from a diversified investment portfolio. We expect to remain selective in acquiring single-family and multi-family residential credit assets and remain committed to prudently managing our liabilities.

NYMT 2025-INV2

$275,253,000

BPL-Rental

September 2025

NYMT 2025-CP1

$369,737,000

Reperforming Loans

July 2025

NYMT 2025-INV1

$253,973,000

BPL-Rental Loans

March 2025

Chief Executive Officer

President

Chief Financial Officer

At Adamas, we have built a portfolio of single family and multifamily residential assets that provides risk-adjusted returns over changing economic conditions.

Our track record of delivering a solid performance is the byproduct of our investment

strategy, efficiencies created by our investment platform and our approach to business.

Join a talented group of people who are passionate about what they do and how they do it.

90 Park Avenue, Floor 23

New York, NY 10016